- Stellar rejected a new yearly high of around $0.44 after a remarkable bullish price action.

- XLM/USD must hold above $0.32 to avoid correction to the next support targets at $0.25 and $0.20.

Stellar has in the last 24 hours soared to astronomical levels, perhaps becoming one of the most improved altcoins. The cross-border token is up 78% to exchange hands at $0.33. Meanwhile, it has also corrected from a new yearly high of $0.44.

Looking at the daily chart, XLM was trading in the confines of a descending parallel channel before the breakout came into the picture. Support slightly above the 100 Simple Moving Average came in handy. On the other hand, trading past the 50 SMA boosted the price upwards in a couple of successive bullish candlesticks.

The noteworthy price action has displayed a bullish outlook. However, it is essential to realize that the Relative Strength Index (RSI) shows Stellar is already oversold. In other words, it is essential to tread carefully because a reversal could well come into the picture.

XLM/USD daily chart

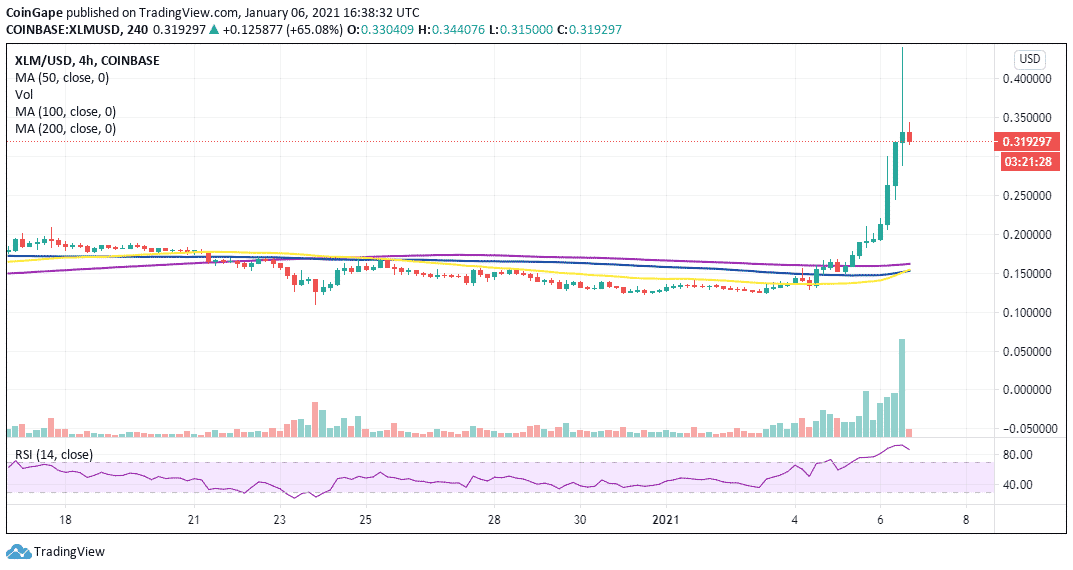

Consequently, the 4-hour chart hints at a possible reversal, especially with the RSI retreating from the overbought region. Moreover, volatility is likely to swing to the bearish side in the coming sessions. The pessimistic outlook is confirmed by the 50 SMA closing the day under the longer-term 100 SMA.

XLM/USD 4-hour chart

On the other hand, a bullish outlook will come into the picture if Stellar closes the day above the immediate support at $0.30. Besides, gains past $0.35 may catapult XLM to higher levels, and even hit new yearly highs towards $0.5.

Stellar intraday levels

Spot rate: $0.325

Relative change: 0.132.

Percentage change: 78%

Trend: Bearish

Volatility: Low

The post Stellar price blasts to the moon following a 78% upswing in 24 hours appeared first on Coingape.